New data released Thursday raises questions about whether the labor market is weakening further — and that could prompt the Federal Reserve to cut rates by more than a quarter of a percentage point when officials meet in less than two weeks.

ADP’s national employment report for August showed that 99,000 jobs were added in the month, well below the 145,000 economists had estimated and fewer than the 122,000 jobs created in July. The August data marked the fifth straight month that job gains have slowed from the previous month. It was the fewest number of private sector jobs added in a month since January 2021.

At the same time, weekly jobless claims reached 227,000 for the week ended August 31, compared with expectations of 230,000, a level incompatible with a recession.

The mixed jobs data, which showed a slowdown in hiring but not layoffs, comes ahead of Friday’s all-important nonfarm payrolls figure, which will reverse or confirm July’s weak jobs report.

Policymakers are wondering whether the rise in the unemployment rate to 4.3% in July was due to exogenous factors such as the impact of a hurricane in Texas at the time, or whether it was the start of a more worrisome trend.

Economists expect the labor market to rebound in August, with estimates of 165,000 jobs, up from 114,000 in July. Both figures are still below the average monthly gain of 215,000 jobs over the previous 12 months. The unemployment rate is expected to fall to 4.2% from 4.3%.

“Tomorrow’s jobs report could be weaker than expected given the softening of ADP estimates,” said Jeffrey Roach, chief economist at LPL Financial. “If the jobs report surprises investors and comes in weaker than expected, the likelihood of a 50 basis point cut at the next Fed meeting increases.”

The July jobs report sent markets into a tailspin, sparking recession fears and raising questions about whether the Fed was too slow to cut rates. Another weak jobs report could add to market concerns, sparking more selling pressure.

The Fed, which had focused more on inflation in recent years, is now turning its attention to the weakening labor market as officials consider cutting rates for the first time in four years this month.

“Our current policy rate level gives us ample room to respond to all the risks we may face, including the risk of further undesirable weakening in labor market conditions,” Powell said in a speech in Jackson Hole, Wyoming, on August 23.

Learn more: What the Fed’s Interest Rate Decision Means for Bank Accounts, CDs, Loans and Credit Cards

Fed officials said they were looking at the whole picture, not just one report.

Asked whether the Fed could cut interest rates by 50 basis points because of the weak August jobs data, Philadelphia Fed President Patrick Harker said: “It’s not just a weak jobs report, it’s weak jobs data. I’m a firm believer that you don’t want to look at any one number because we know that those numbers are subject to revision. You want to look at all the data: job applications, job transitions, the soft data that we’re getting from employers.”

The so-called “soft” data also shows a slowdown in hiring, but not mass layoffs, as official data show.

The Fed’s Beige Book, a compilation of anecdotal data from the field in the Fed’s regional districts, released Wednesday found that employment levels were broadly stable across the Federal Reserve’s 12 districts, though there were isolated reports that companies had filled only necessary positions, reduced hours and shifts, or lowered overall employment levels through cutbacks. Still, reports of layoffs remained rare.

Employers are more selective in hiring and less likely to expand their workforce, citing concerns about demand and an uncertain economic outlook. Companies feel less pressure to raise wages as competition for workers has eased.

The Beige Book also revealed that consumer spending declined in most districts, after remaining generally stable in July.

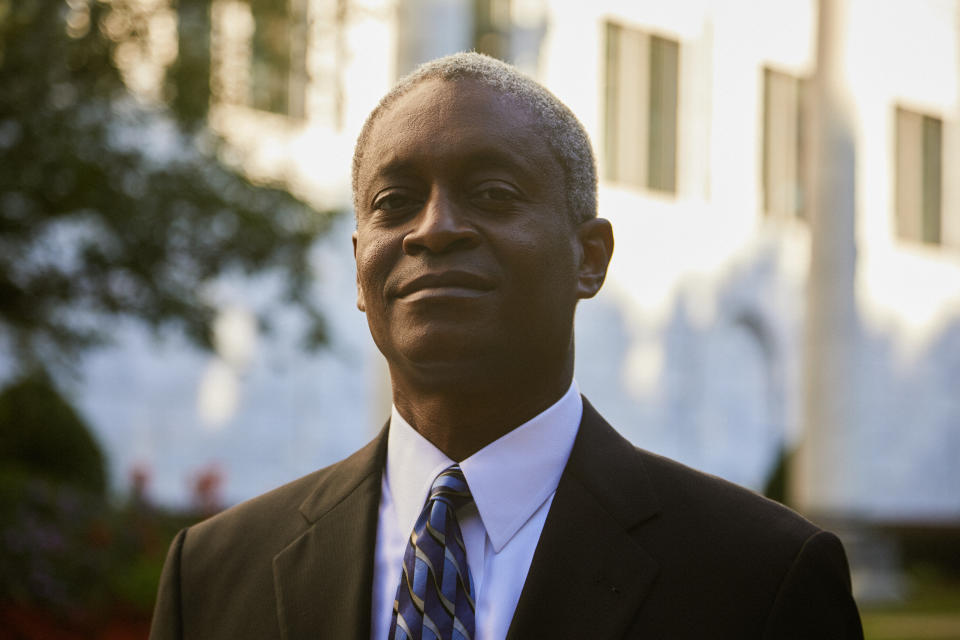

Atlanta Fed President Raphael Bostic said Wednesday that the Fed must cut rates before inflation hits 2%, lest the central bank “risk disrupting the labor market, which could inflict unnecessary pain and suffering.”

Still, Bostic said that while the job market “continues to weaken, it’s not weak.”

“I don’t sense a crash or panic among business contacts,” Bostic said. “However, the data and our feedback from the field describe an economy and a labor market that are losing momentum.”

Traders are pricing in a nearly 60% chance that the Fed will cut rates by 25 basis points in a few weeks. A much weaker jobs report on Friday would tip the odds in favor of a half-point cut.

Gregory Daco, EY chief economist, said that while he believes the Fed is late in cutting rates, a 25 basis point cut seems more likely.

“It is not clear that Powell will be able to convince a majority of policymakers to vote for a 50 basis point rate cut to kick off the easing cycle,” Daco said. “A deeper cut would be an implicit admission that the Fed made a policy mistake by not easing sooner.”

Jennifer Schonberger is a veteran financial journalist who covers markets, economics, and investing. At Yahoo Finance, she covers the Federal Reserve, cryptocurrencies, and the intersection of business and politics. Follow her on X @Jenniferisms.

Click here for the latest economic news and indicators to help inform your investment decisions

Read the latest financial and business news from Yahoo Finance

#jobs #data #test #Fed #cut #rates #ahead #governments #employment #report