U.S. banking sector profits rose in the second quarter from the previous quarter. But credit quality continued to deteriorate, according to the FDIC’s quarterly report.

The banking sector’s mixed second-quarter performance puts it on a good footing ahead of the Federal Reserve’s signal that it will begin cutting its benchmark interest rate in a few weeks.

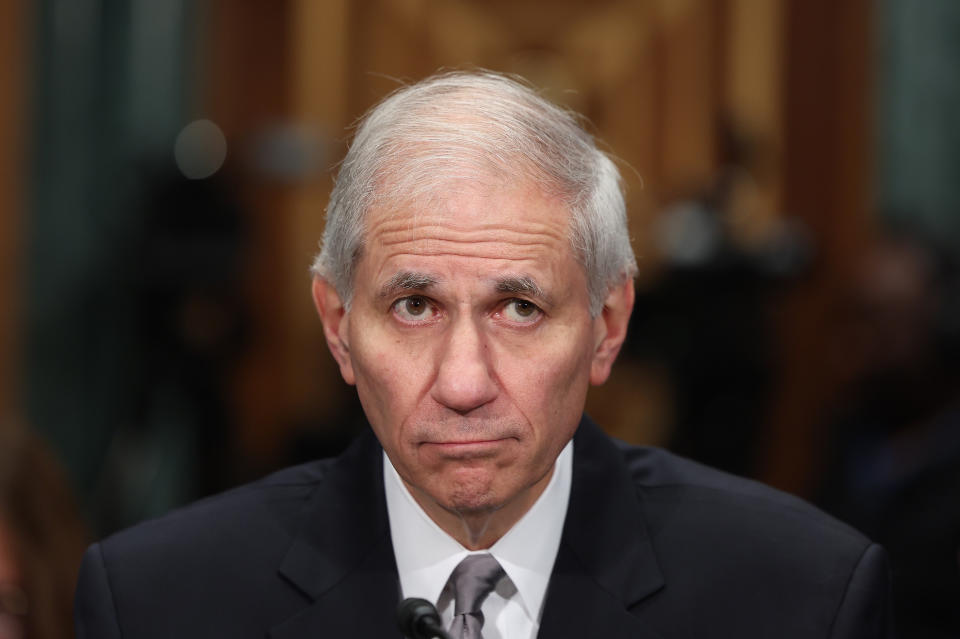

“The banking sector continued to demonstrate resilience in the second quarter. However, the sector continues to face significant downside risks related to uncertainty in the economic outlook, market interest rates and geopolitical events,” FDIC Acting Chairman Martin Gruenberg said in a statement.

He added: “These issues could lead to credit quality, earnings and liquidity problems for the sector.”

Overall, profits reached $71.5 billion, up 11.4% from the first quarter, although slightly down from the same period a year earlier.

The gain was “primarily due” to one-time gains by major banks on their holdings, as well as the absence of fees from the banking regulator to repay the Federal Deposit Insurance Fund to cover regional bank failures last year. During the quarter, JPMorgan Chase (JPM), PNC (PNC) and Northern Trust (NTRS) recorded gains on long-held shares from the Visa (V) IPO worth nearly $10 billion.

—The sector’s credit quality deteriorated slightly, with the charge-off rate for nonperforming loans, or net charge-offs, increasing 3 basis points to 0.68% from the previous quarter. That rate is the highest level since the country’s last major credit cycle a decade ago, driven by credit card lending and non-owner-occupied commercial real estate loans, the report said.

The sector’s share of non-current loans, or those at higher risk of becoming uncollectible because they are 90 days past due, remained unchanged and below the pre-pandemic average.

The slight increase in the impaired loan rate during the quarter was mainly due to credit cards and non-owner-occupied commercial real estate loans, the report said.

In the second quarter, credit card loans held by banks reached their highest rate since the third quarter of 2011.

As the Federal Reserve prepares to begin cutting interest rates later this month, the FDIC report covers what is expected to be the tail end of the industry’s profits after two years of tighter monetary policy. High rates have helped the industry’s largest players post record profits, but industry margins also continue to be squeezed.

Learn more: What the Fed’s Interest Rate Decision Means for Bank Accounts, CDs, Loans and Credit Cards

Net interest margin, which measures the interest banks earn minus the interest they pay on deposits and other funding sources, declined slightly in the second quarter and was below its pre-pandemic historical average, according to FDIC data going back to 2008. The decline in margins came primarily from large banks with $250 billion or more in assets.

Meanwhile, the industry’s unusually high losses on low-yield bonds totaled $513 billion in the second quarter, down $4 billion from the previous quarter. In July, PNC (PNC), Truist (TFC) and other regional banks said they had taken billions of dollars in losses on their underwater bonds to improve margins ahead of expected rate cuts.

Lower rates are believed to reduce the drop in profitability that banks are currently experiencing from their low-yielding securities and bonds invested during or before the pandemic, making a big difference to lenders as long as their borrowers can continue to pay their interest.

“I think a particular benefit to the banking sector, if the Fed were to lower rates, would be some benefit on their balance sheet exposure to these assets,” Gruenberg told reporters at a news conference.

“Weakness in some loan portfolios, including office properties, credit cards and multifamily loans, continues to warrant monitoring,” he added.

David Hollerith is a senior reporter for Yahoo Finance covering banking, crypto, and other areas of finance.

Click here for an in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance

#Banks #posted #strong #profits #quarter #bad #news #risky #lending #rate #remained #highest #level #years